how to calculate rpgt

Imagine you applied for a personal loan of RM100000 at a flat interest rate of 5 pa. Due to the MCO period Selangor land offices are having a new SOP.

Real Property Gains Tax Valuation And Property Management Department Portal

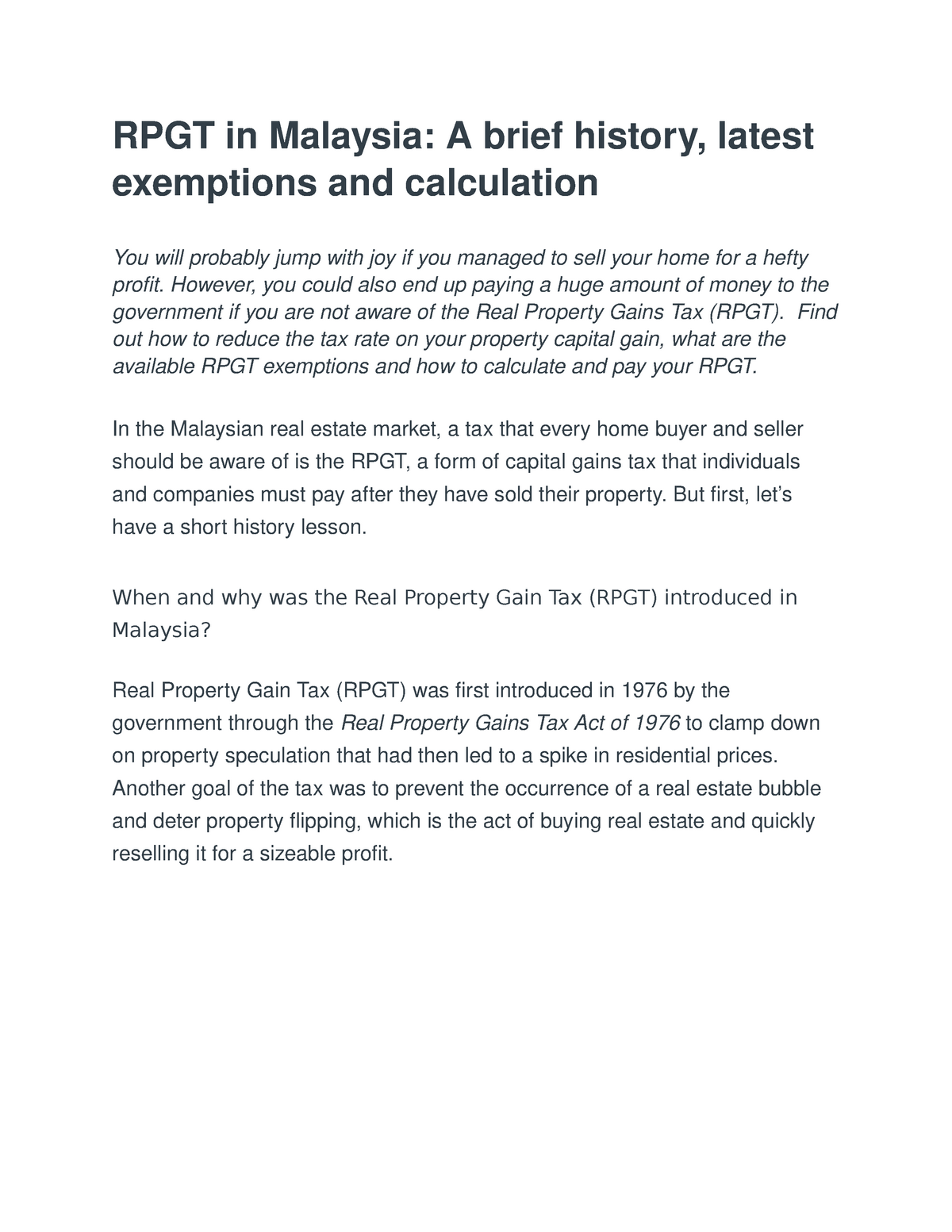

How to calculate RPGT and what kind of impact does it have on you.

. Calculate Home Loan Personal Loan and Car repayments for free. A flat interest rate is always a fixed percentage. Youll pay the RPTG over the net chargeable gain.

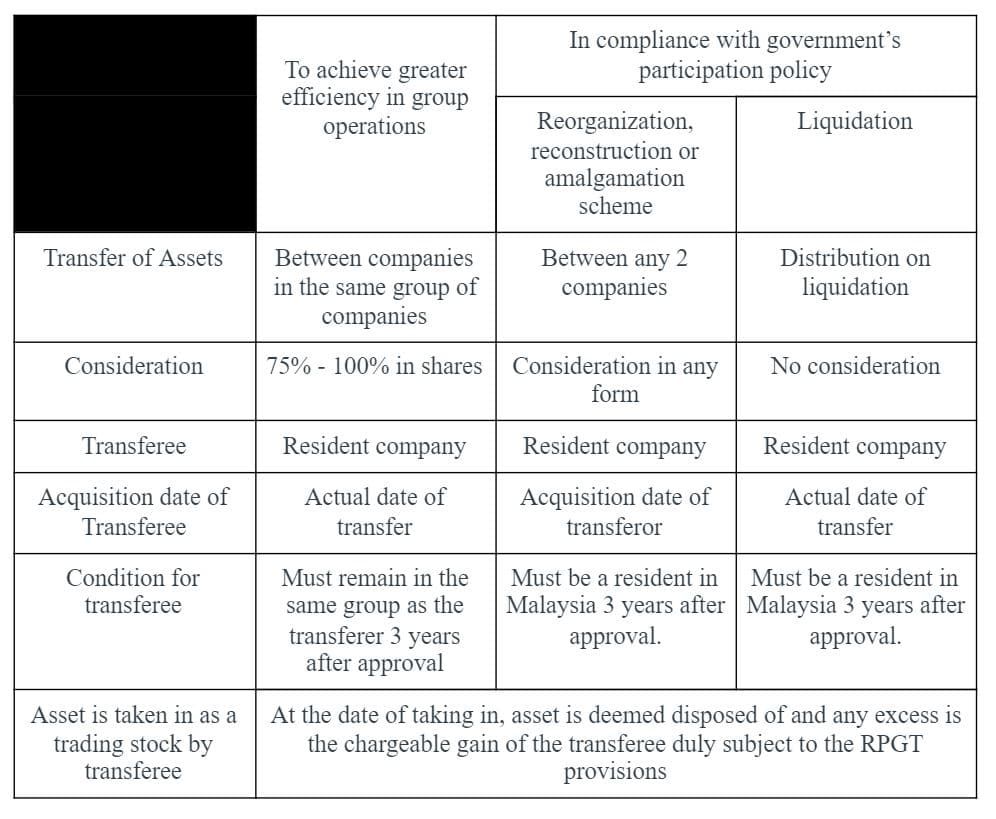

A capital gains tax CGT is the tax on profits realized on the sale of a non-inventory assetThe most common capital gains are realized from the sale of stocks bonds precious metals real estate and property. SUPERIOR IT SOLUTIONS SDN. As part of PENJANA the Real Property Gains Tax RPGT will also be exempted for the disposal of properties.

Said properties must be residential homes sold between 1 June 2020 to 31. Find a competitive interest rate for your hire-purchase from 18 banks in Malaysia. We will have to increase the price for the LOCAL Selangor land search to RM30 Effective since 19th June 2020.

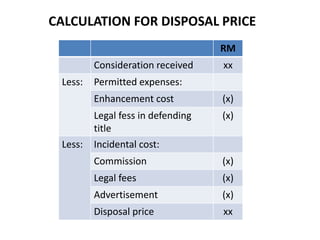

To know the taxable amount first calculate your chargeable gain which is the difference between the purchase price and the sale price. Increment and Reduction in income tax. Able to calculate Carry-back losses YA 2009 Calculate Section 60F deduction automatically.

Real Property Gains Tax RPGT in Malaysia 2022 How Inflation Affects Loan Installments UPDATED 2022 Avoid These BLACKLISTED Property Developers in Msia. 6pm Score deals on fashion brands. Disposal Date And Acquisition Date.

SOCSO PTPTN Subsidies RM100 for M40 More Top Articles. I can even save share the results with clients instantly. Tax Secretary MBRS RPGT Time Cost Accounting Software in Malaysia.

How To Calculate RPGT Malaysia. Under the law you are compelled to pay your quit rent parcel rent and assessment rates. Under the recent Budget 2022 Finance Minister Tengku Zafrul announced that the government will no longer impose Real Property Gains Tax or RPGT for property disposals by individuals comprising Malaysian citizens and permanent residents starting from the sixth yearThis means that the RPGT rate for property disposals in the 6th year and.

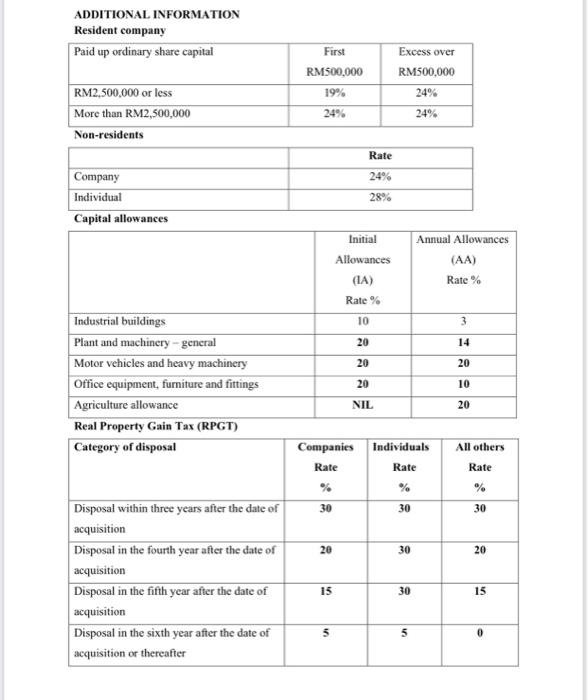

Real Property Gains Tax RPGT Rates. The flat interest rate is mostly used for personal and car loans. Compare and calculate your monthly repayments on Loanstreets car loan calculator and save more than RM100 every month.

Now I can calculate my clients legal fees stamp duty easily. IProperty Based on the Real Property Gains Tax Act 1976 RPGT is a tax on chargeable gains derived from the disposal of property. Calculate interest restriction automatically.

Harga Pelupusan Dianggap Bersamaan Dengan Harga Pemerolehan Available in Malay Language Only Transfer Of Asset Inherited From Deceased Estate. Income Tax Act 1967 Schedule 3 stated clearly that the maximum qualifying expenditure for a private vehicle not licensed on a commercial basis is RM50000 RM100000 if the purchased vehicle is a new vehicle and its value is less than RM150000 this is why everybody believe register private vehicle under. Easylaw solves this for me.

Capital allowances consist of an initial allowance IA and annual allowance AA. RPGT Exemptions 2022. Let us first calculate the capital gains made on on your real estate investment.

With a tenure of 10 years. IA is fixed at the rate of 20 based on the original cost of the asset at the time when the capital was obtained. The rates are between 5 to 30 depending on how long you have owned the property.

If you delay in making timely payments a notice of arrears would be sent to you notifying you of the payments due as. With all that said heres an example of how to calculate your net rental income. Shopping for a car loan for your new or used car.

Not all countries impose a capital gains tax and most have different rates of taxation for individuals versus corporations. We will have to comply with every rule and regulation. Amazon Drive Cloud storage from Amazon.

Heres How To Calculate a Rental Yield in Malaysia for a Good ROI BAJET2023. Determination Of Chargeable Gain Allowable Loss. Superior Tax Comp Superior ComSec Superior TimeCost Superior SST.

Income Tax Act 1967 Schedule 3 stated clearly that the maximum qualifying expenditure for a private vehicle not licensed on a commercial basis is RM50000 RM100000 if the purchased vehicle is a new vehicle and its value is less than RM150000 this is why everybody believe register private vehicle under. Able to calculate Carry-back losses YA 2009 Calculate Section 60F deduction automatically. Calculating RPGT is a fairly simple process.

Tax payable Net Chargeble Gain X RPGT Rate based on holding period RM171000 X 5. Lim32Conveyancing Lawyer PJ. Superior Tax Comp Superior ComSec Superior TimeCost Superior SST.

Disposal Price And Acquisition Price. Calculate interest restriction automatically. Tax Secretary MBRS RPGT Time Cost Accounting Software in Malaysia.

Get to know your Housing Loan Eligibility RPGT on Loanstreet now. Note down the purchase price of. What is Real Property Gains Tax RPGT in Malaysia How to calculate it.

Amazon Advertising Find attract and engage customers. RPGT is only payable if you profit from the sale. Gross rental income Monthly rent.

The RPGT rates in Malaysia has changed several times over the years so always check the latest RPGT rates. SUPERIOR IT SOLUTIONS SDN. Land Office Charges will be subject to the official land office charges at each state.

If you owned the property for 12 years youll need to pay an RPGT of 5. Real Property Gains Tax RPGT RPGT is tax you pay when you sell your property. RPGT calculation can be quite complicated and confusing when I am calculating my clients and my own investment.

For contracts that are signed for anywhere between 1 to 3 years the stamp duty rate is RM2 for every RM250 of the annual rent in excess of RM2400. What happens if you default on your land tax payments. Amazon Music Stream millions of songs.

Top 5 Performing Funds For Short Term Investment 1 month - 5 Years If youre investing for short term gain typically within 1 month to 5 years you must make sure that the fund youre investing can give a higher return than fixed deposit rate which averages around 3. Check for latest flat interest rate and effective interest by banks. Basically the Stamp Duty for Tenancy Agreements spanning less than one year is RM1 for every RM250 of the annual rent in excess of RM2400.

Heres How To Calculate a Rental Yield in Malaysia for a Good ROI Real Property Gains Tax RPGT in Malaysia 2022 3 Things You Should Know Before Buying An Auctioned Property. Increment and Reduction in income tax. A chargeable gain is a profit when the disposal price is more than the purchase price of the property.

And if the Tenancy Agreement has been signed for more than 3 years the. RPGT would then be calculated by multiplying your chargeable gain with the relevant RPGT rate. Save time for me.

Real Property Gain Tax Rpgt 2020 Malaysia Housing Loan

5 Tax Considerations When Selling Off Your Property Iproperty Com My

All You Need To Know About Real Property Gains Tax Rpgt

Solved Question 3 25 Marks A Rpgt Is A Tax On Capital Chegg Com

Rise Of Rpgt And Stamp Duty Rate In Malaysia

Naila Nair Nailanair Profile Pinterest

Understanding The Concept Of Real Property Gains Tax Rpgt Wma Property

Real Property Gains Tax Rpgt 2022 In Malaysia How To Calculate It Iproperty Com My

An Insight Into Real Property Gains Tax Rpgt Properly

Real Property Gains Tax Its Rates 2022 Publication By Hhq Law Firm In Kl Malaysia

Real Property Gains Tax Rpgt 2022 In Malaysia How To Calculate It Iproperty Com My

Real Property Gains Tax Rpgt In Malaysia And Why It S So Important

Rpgt In Malaysia A Brief History Latest Exemptions And Calculation Rpgt In Mal Aysi A A Brief Studocu

Rpgt For Company In Malaysia L The Definitive Guide 2022 Industrial Malaysia

Real Property Gains Tax Rpgt In Malaysia 2022

Rpgt For Company In Malaysia L The Definitive Guide 2022 Industrial Malaysia

Real Property Gains Tax Part 1 Acca Global

Mq Rpgt Tax Guide For Homeowners A Real Property Gains Tax Rpgt Is The Imposition Of Tax On Your Profits From Selling A Property In Simpler Terms If You Own A

Comments

Post a Comment